Certificate of Deposit Vs Bankers Acceptance

A CD bought through a federally insured bank is insured up to 250000. For example one of Bank of Americas products comes with a minimum balance of 10000 with an option to choose terms between 7-35 months.

Commercial Papers And Certificate Of Deposit

Certificate of Deposit Examples.

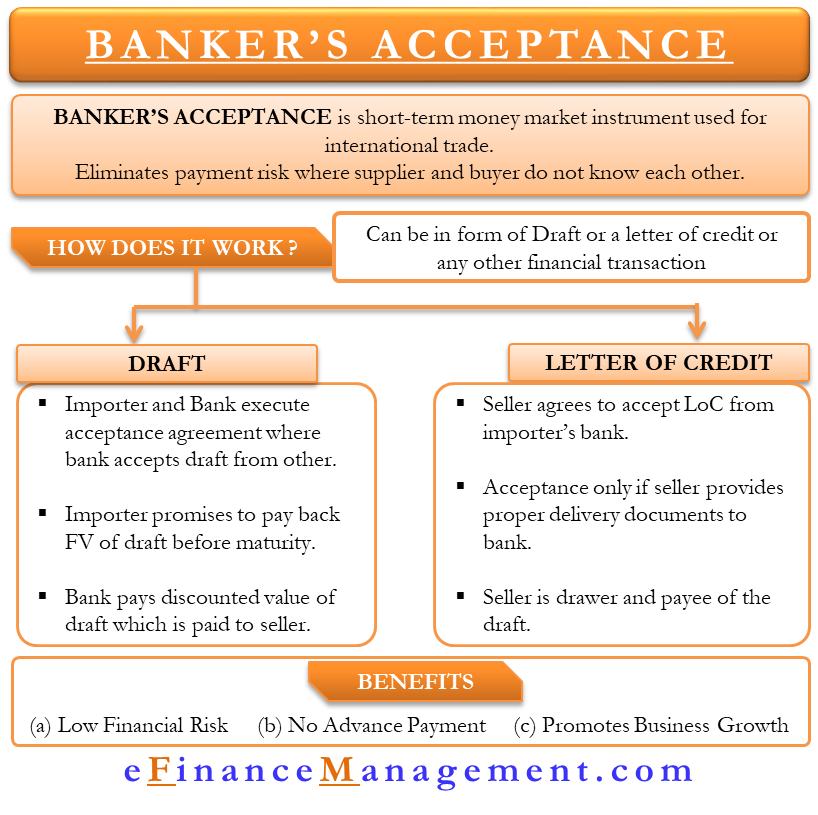

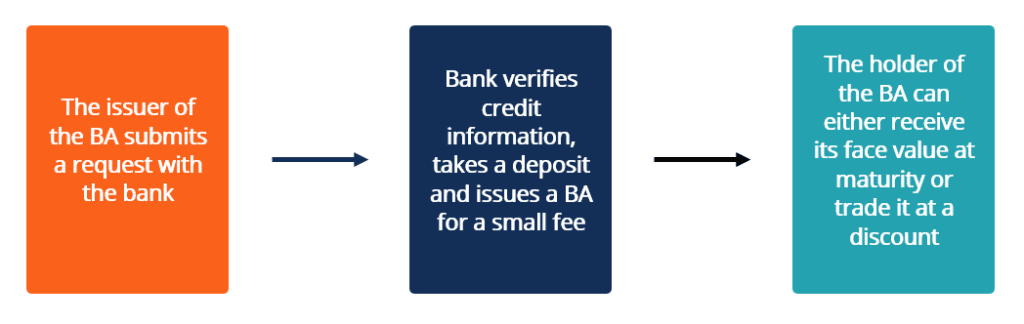

. A bankers acceptance BA aka bill of exchange is a commercial bank draft requiring the bank to pay the holder of the instrument a specified amount on a specified date which is typically 90 days from the date of issue but can range from 1 to 180 days. Certificates of deposit are considered to be one of the safest savings options. This agreement is for a specific period of time with a certain amount of money to invest where the financial institution pays interest.

As with all investments there are benefits and risks associated with CDs. A real-world example of a certificate of deposit could be those offered by commercial banks such as the Bank of America Fidelity or Discover Bank etc. By accepting the draft the bank makes an unconditional promise to pay the holder of the draft a stated amount at a specified date.

It is guaranteed by a bank to make payments. You can redeem at the time of maturity of the instrument. Bankers acceptances are discount securities.

In addition the deposit is guaranteed by the bank that issues it. Commercial Papers have higher denominations as compared to the Treasury Bills and the Certificate of Deposit. They are very safe since the financial situation of the corporation can be anticipated over a few months.

Compare the Rates of Top Banks. Certificates of deposit are generally thought of as one of the safest types of investments. The 250000 insurance covers all accounts in your name at the same bank not each CD or account you have at the bank.

Bankers Acceptance Advantages And Disadvantages. Even if the bank collapses the owner of the CD will still get their money returned. The primary difference between a CD and a Fixed Deposit is that of the value of the principal amount that can be invested.

A certificate of deposit CD is a document issued by the bank to an investor who chooses to deposit his funds in the bank for a specific amount of time. The former are issued for large sums of money 1 lakh or in multiples of 1 lakh thereafter. A bank rather than an account holder guarantees the payment.

Advantages And Disadvantages Of Banks Efinancemanagement Com. The Bankers Acceptance is traded in the Secondary market. COMMERCIAL PAPER is an unsecured shor.

Chapter 11 Commercial Banks Major Corporations And Federal Credit. The bankers acceptance is issued at a discount and paid in full when it becomes due the. Commercial Papers have higher denominations as compared to the Treasury Bills and the Certificate of Deposit.

Banker S Acceptance Definition Advantages Disadvantages Study Com. Certificate of deposit CD is an agreement between the depositors and the authorized bank or financial institution. In fact banks sometimes use the terms interchangeably.

Pros And Cons Of Bank Guarantee It Mitigates Risk But At A Cost Efm. BANKERSS ACCEPTANCE also known as Bill of Exchange is a commercial bank draft requiring the bank to pay the holder of the instrument a specified amount on a specified date which is usually 90 days from the date of issue but can be up to 180 days. Once the money has been deposited the depositor cannot withdraw the funds before maturity without incurring a penalty for early withdrawal.

Bankers acceptance BA is a negotiable piece of paper that functions like a post-dated check. A negotiable certificate of deposit is a CD with a minimum face value of 100000. A Bankers acceptance BA is a short-term debt security created when a time draft drawn on a bank usually to finance the shipment or temporary storage of goods is stamped accepted by the bank.

The maturity period of Certificates of Deposit ranges from 7 days to 1 year if issued by banks. Firstly the fixed interest rate locks in the amount of yield that is going to be earned reducing the volatility of returns for the investor. Ad Get 30X the National Average CD Rate.

It is a short-term credit investment. T-bills commercial paper and. The maturity period of Commercial Papers are a maximum of 9 months.

It is guaranteed by a. Learn more about great rates at Synchrony Bank. Ad Enjoy the Highest Return Available on Your CD Deposit.

Sign Up for Features Designed to Help You Make Smart Choices About Your Money. Let us look at some. As long as the CD issuer is FDIC-insured the banks promise to return the money is covered up to the 250000 FDIC limit just like funds in your savings or checking account.

Bankers acceptances also known as. Education General Dictionary Economics. Bankers Acceptances Created in the Federal Reserve Act of 1913 Purpose is to facilitate domestic and international commercial transactions A bankers acceptance is a time draft bill of exchange with a maturity of six months or less The bank on which the instrument is drawn stamps.

There are a few minor differences between a certificate of deposit and a fixed deposit. These savings vehicles allow you to put funds away for a set period of time. Ad Open a 16 Month CD with Synchrony Bank today.

It is a short-term credit investment. The word accepted across the face of the draft. Certificates of deposit are typically FDIC-insured.

Commercial Papers And Certificate Of Deposit

0 Response to "Certificate of Deposit Vs Bankers Acceptance"

Post a Comment